User Review

( votes)Summary

Introducing the market trading to developing countries in Africa is likely to be one of the most significant ways of empowering millions of investors who are busy searching for financial independence.

Pros

• Well-known brand in South Africa

• Excellent educational resources and customer support

• Very secure, safe and highly regulated

• An extensive array of tradable assets across the world market

Cons

• No promotions and bonuses

It can’t go unnoted that many investors, especially in South Africa, would like to join millions of other forex traders in the world. The problem comes in finding the best and most reliable forex partners. This makes them fearful of investing their capital in brokers whose reliability is in question.

Before choosing a trading partner, one needs to put the following factors into consideration.

The Forex Broker’s Reliability

There are dozens of FX brokers in the market. Some have been there for decades and famous among traders worldwide while there are still many ‘no-name’ companies.

It’s advisable that when looking for a forex broker, choose someone who has been in the trading industry for at least ten years. Someone with trading experiences knows what it takes for one to make profits as well as the most efficient way of handling clients.

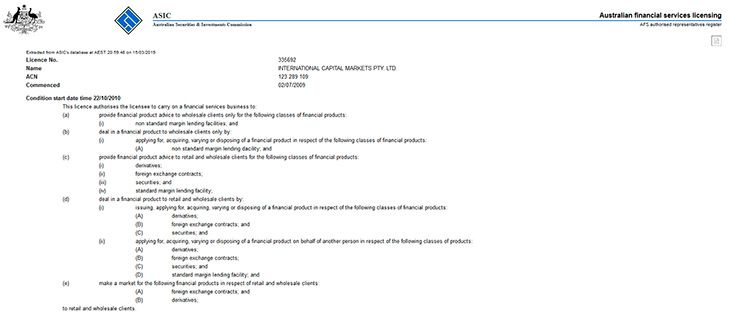

Regulation, Authorization and Licensing

An unregulated trading company is not fearful of misusing the clients’ funds. Such a company is never concerned about observing the laws put in place to ensure that its activities are lawful. Most of the online scammers are unlicensed, and once they realise that they have your money, they close down leaving you helpless.

Before choosing a forex broker, check keenly and ensure that the company is licensed, regulated and authorised by major oversight bodies. Go for the broker who voluntarily submits himself to the government oversight.

The following are some of the oversight bodies that regulate forex traders and platforms in most nations worldwide;

- Autorite´ des Marche´s Financiers (AMF) of France

- Swiss Federal Banking Commission (SFBC) of Switzerland

- Financial Services Authority (FSA) of the United Kingdom

- Bundesanstalt fÜr Finanzdienstleistungsaufsicht (BaFin) of Germany

- Australian Securities and Investment Commission (ASIC) of Australia

- Commodity Futures Trading Commission (CFTC) and National Features Association (NFA) of the United States

Variety of the Products Offered by the Broker

Most brokers offering a single product variety are likely to walk away with your hard-earned capital. Before going for a broker, check carefully to see the number of products offered. In most cases, traders offering various products such as commodities and securities have a broader business reach and bigger client bases. This means that many other clients trust them, and you could trust them also.

Reputation

Clients look for brokers with easy transactions and good customer support alongside transparency. Choose to partner with a forex broker with a good reputation.

It’s sad to note that only a few forex brokers have the above-outlined qualities, and unless one is careful enough, their capital would be at risk. But if you are new in the market, and you are looking for a good reliable and transparent broker, then IC Markets is here for you. With this broker, your funds are safe, and you don’t need to struggle in making transactions.

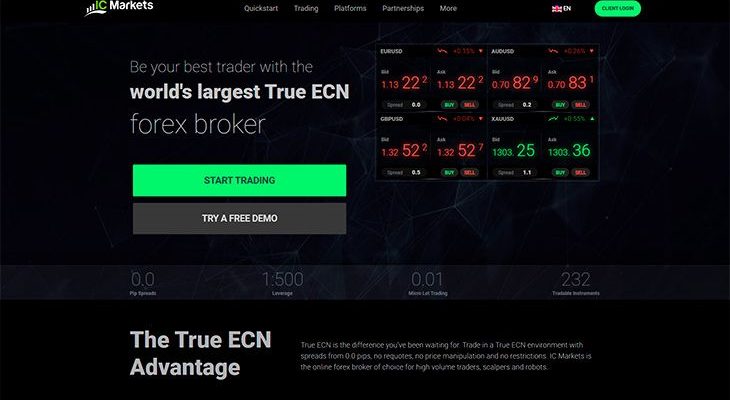

What is IC Markets?

ICMarkets is one of the biggest online ECN forex broker firms in the world. The company is based in Australia but serves the interests of investors across the globe. It is very popular in South Africa also. It offers various products such as indices, forex, equity markets and bonds in Europe and Asia.

Having been founded in 2007, it is in operating for the past 12 years. This means that it has gained a lot of experience in forex trading as well as handling clients with efficiency and professionalism.

Is IC Markets Reliable?

ICMarkets is a reliable and highly reputable forex broker that has been providing global traders with trading services and reliable investment for more than 12 years. The company is a true ECN broker, meaning that there is no sort of intervention between the client and the market. Neither does it have a dealing desk, which means that clients deal directly with the real interbank forex market. This boosts the company’s reliability and transparency from the clients.

Also, there is regular auditing on IC Markets. This ensures that the broker is reliable, transparent and complies with the trading regulations. In summary, IC Markets is one of the most reliable and trusted forex brokers available today.

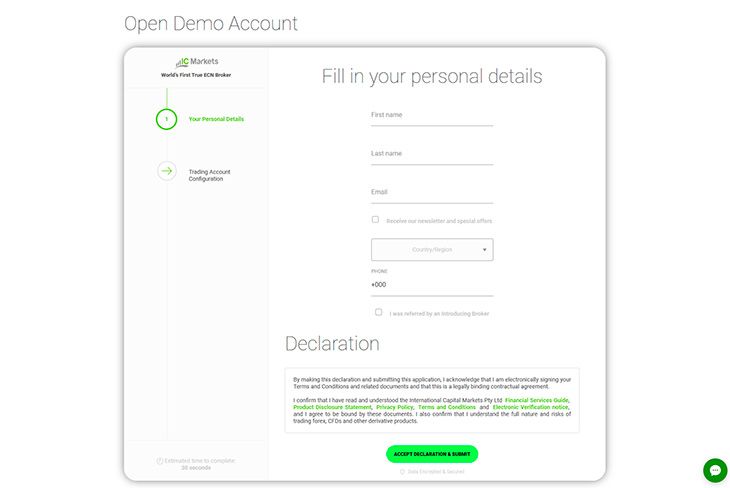

How to Open a Demo Account

A demo account is one of the accounts on IC Markets. To open a demo account, follow the following easy steps;

- On IC Markets website, click on ‘Demo Account’.

- Fill in the form provided, whereby you are required to fill in your personal details;

- First name

- Last name

- Country

- Phone number

- Referral code (optional)

- Click on “Accept Declaration & Submit”

Free Education and Video Tutorials

On the company’s website, you learn on how one experiences ultra-fast execution, tightest spreads as well as free trading conditions on the award-winning MetaTrader4 platform. The education overview includes the following.

Forex advantages

On this section, you learn on the benefits of forex trading. Besides, the section explains why the forex market is one of the reliable arenas for genuine price discovery and fair market competition.

The following are some of the benefits of trading in the forex market;

- 24-hour market

- Liquidity

- Accessibility

- Leverage

- One can trade in both rising and falling markets

- Low trading cost

- Transparency

- Volatility

- Non-Standardized contract sizes

Advantages of CFDs

Here, you learn why trading Index CFDs is beneficial, as well as the reason as to why the Index CFD has become so popular in the trading market. The following are some of the advantages of CFDs;

- Easy speculation in both the rising and falling markets

- Efficient use of capital

- Hedging other investments

- Flexible contract sizes

- Easy access to global financial markets

Video tutorials on getting started with Forex trading

The platform also provides you with educational video tutorials that will help you get started in forex. The videos are designed in a way that they will fit traders of all levels regardless of experience. They provide you with a step by step guide on how to make use of the company’s trading platforms. Besides, the video tutorials answer some of the common questions regarding the trading platforms.

What Assets Can You Trade on IC Markets?

You can trade various assets on IC Markets. These are the assets that will give you easy access to the most liquid and lucrative markets across the globe. The assets that you can trade on ICMarkets include Forex, bonds, indices, commodities, futures, stocks and cryptocurrencies.

The following are some details of these assets and what they offer traders.

Forex

- Deep liquidity

- 60 currency pairs

- Up to 1:500 leverage

- Tight spreads from 0.0 pips

Indices

- Multiple trading platforms

- Up to 1:200 leverage

- 17 indices across the world markets

- No commissions

Stocks

- Meta Trader 5 platform

- Over 120 stocks and ETFs

- Earn dividends

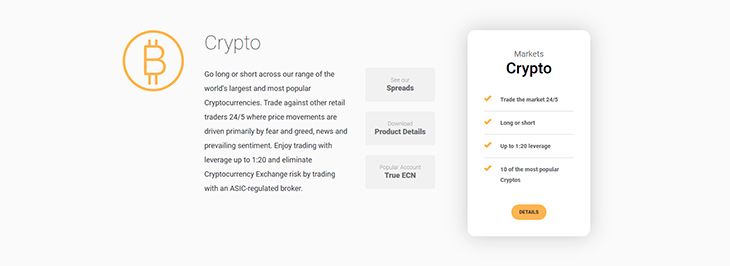

Cryptocurrency

- Five of the most popular cryptocurrencies

- Trade 24 hours in a day and five days a week

- Up to 1:20 leverage

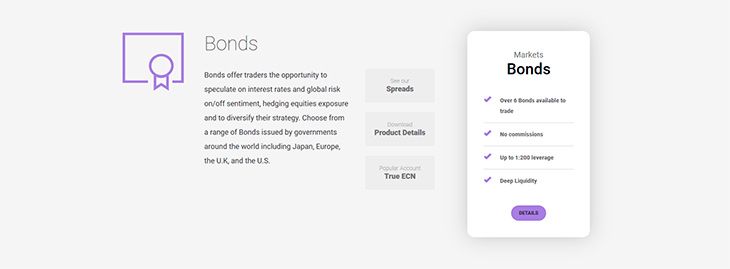

Bonds

- Deep liquidity

- Up to 1:200 leverage

- No commissions

- Over six bonds to trade

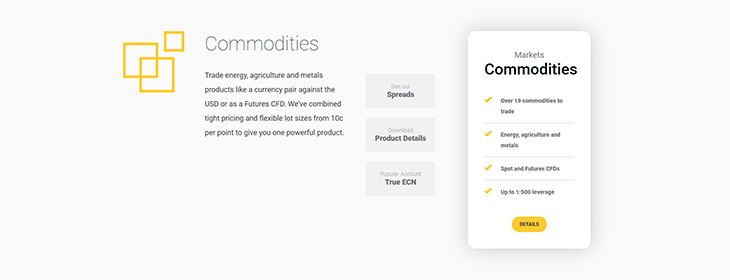

Commodities

- Spot and Future CFDs

- Up to 1:500 leverage

- Over 19 trading commodities

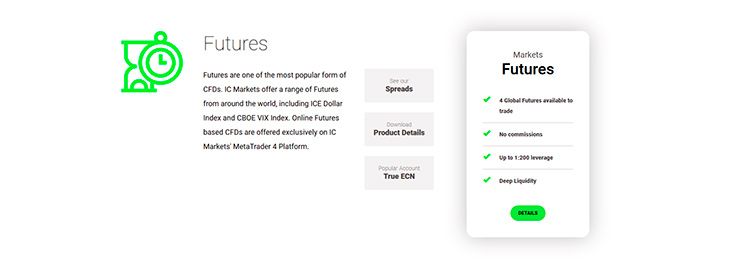

Futures

- Deep liquidity

- Up to 1:200 leverage

- No commissions

- Four global futures to trade

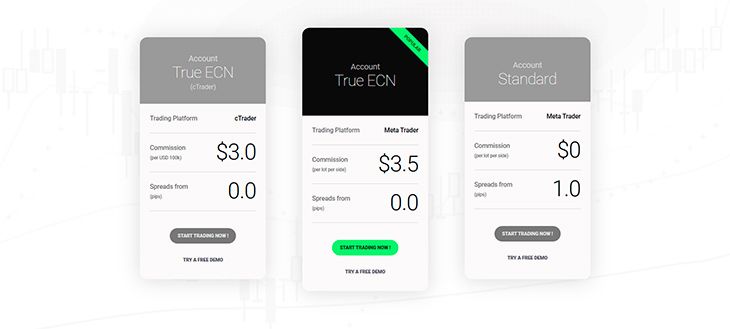

Account Types on IC Markets

The company has various account types fit for everyone who wishes to start trading online.

All the IC Markets accounts are True ECN accounts. Besides, they have the same access to a variety of trading platforms and an extensive product range.

Standard Account

This is best suited for account discretionary traders. The account’s features spread from 1 pip, 1:500 leverage, zero commissions and the suite of Meta Trader platforms.

True ECN Account

If you are a scraper or an expert advisor (EA), this is the best account for you. The trading account’s features spread from 0 pips, $3.50 commissions and 1:500 leverage. The account also features the suites of Meta Trader platforms.

cTrader ECN Account

This is the best trading account for day traders and scalpers. The account was designed to specifically operate in a true ECN environment. This means that it is dedicated to the use of the cTrader platform. The account’s features from 0 pips, 1:500 leverage, ultra-fast order execution and $3.00 commissions.

IC Markets Trading Platforms

MetaTrader 4 (MT4)

This platform is not only found in IC Markets but is also popular among other trading brokerages across the world. The trading platform uses advanced charting tools, a variety of technical advisors, a range of Expert Advisors (EAs) and one-click trading solutions for automated algorithmic trading.

Besides, the platform has lightning fast execution speeds alongside allowing for a variety of advanced order types.

MetaTrader 5 (MT5)

This is the latest addition from Meta Trader platforms, but it’s not as popular as Meta Trader 4. However, this is just an improved and upgraded version of the Meta Trader 4 platform. The platform features flexible deposit and withdrawal options, marked depth, tight spreads and a flexible lot sizing.

cTrader

This platform was explicitly designed for ECN trading environment that uses automated trading software. The platform provides traders with options for automated trading implementation;

- Myfxboook’s AutoTrade

- Signal Trader’s mirroring technology

- ZuluTrade

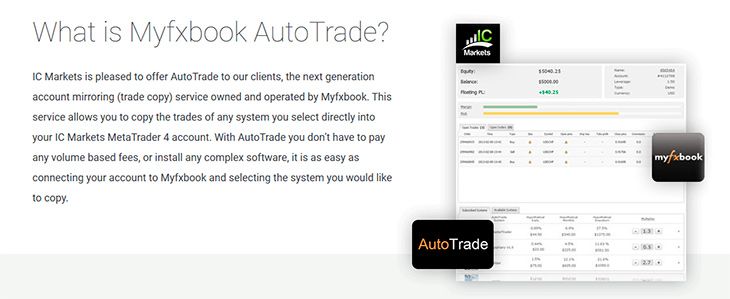

Myfxbook AutoTrade

This is a service that allows traders to copy other trades systems directly into their IC Markets MT4 accounts. By doing so, they don’t need to pay any volume-based fees or install any complex software. They can easily connect their accounts to Myfxbook and select the systems they would like to copy.

The following are some of the benefits of Myfxbook;

- Only the best systems are shown

- Real accounts only

- No incentives

- Accurate statistics

- Full control

- Transparent fees

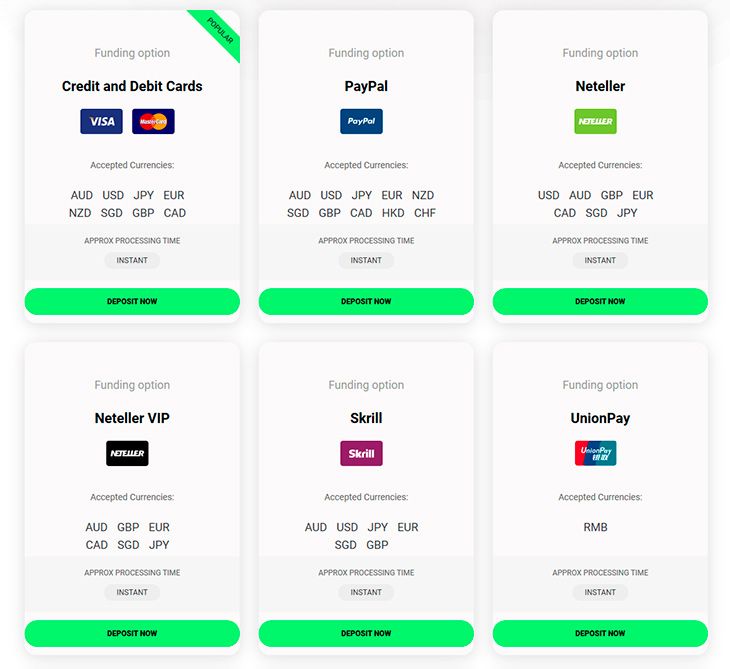

How to Make a Deposit

You are provided with a variety of deposit and withdrawal options. These options are tailored towards suiting a wider variety of traders needs. The following are some deposit options that you can use to fund your account.

- PayPal

- Credit and Debit Cards

- BPay Deposit

- Bank Wire Transfer

- Branch Cash Deposit

- Broker to Broker transfers

- Neteller

- Skrill

- QIWI

- Webmoney

- POLi

- FasaPay

- China Union Pay

How to Make Withdrawals

One can withdraw using most of the above methods, and they will most likely be processed on the same day. There are no fees charged upon withdrawals. However, international bank wire withdrawals are charged a fee of about $20.

Frequently Asked Questions on IC Markets (FAQs)

I want to open a demo account. How can I do it?

To open a Demo account, follow the following steps;

- On IC Markets website, click on ‘Demo Account’.

Fill in the form provided, whereby you are required to fill in your personal details;

- First name

- Last name

- Country

- Phone number

- Referral code (optional)

- Click on “Accept Declaration & Submit”

How long do I have to wait after making a withdrawal?

Withdrawals are mostly processed on the same working day. So, you will wait for 1-2 working days before the processing is complete. It also depends on the banking options that you use to deliver your earnings.

How safe is IC Markets?

IC Markets is very safe and reliable. There is regular auditing on IC Markets to ensure that the broker is reliable, transparent and complies with the trading regulations.

What makes IC Markets different from other forex brokers?

The following are some of the things that make IC Markets unique from others:

Regulation – IC Markets is regulated and licensed by the Australian Securities and Investment Commission (ASIC)

Reliability – The forex broker is reliable; following the fact that the company is audited regularly to ensure that it complies with the laws.

Easy deposits and withdrawals – No charges are imposed upon withdrawals, except for international bank wire withdrawals.

Pros of IC Markets

- Well-known brand in South Africa

- Excellent educational resources and customer support

- Very secure, safe and highly regulated

- An extensive array of tradable assets across the world market

Cons

- No promotions and bonuses

IC Markets Overall Rating

Clients from South Africa and other African countries highly rate IC Markets as one of the best and most reputable and reliable forex brokers. From their many years of experience, the broker has adopted the culture of handling clients with a high level of professionalism.