User Review

( vote)Summary

Tickmill.com is a provider of premium financial instruments and trading services featuring fast execution, low spreads, 100% transparency, no requotes, and the latest technology. Tickmill Ltd which has extensive experience in the industry owns and operates Tickmill.com.

Pros

• Licensed and regulated

• Dedicated client support

• Spreads that start from 0 pips

• 84 trading instruments

• Negative balance protection

Cons

• No cryptocurrency trading

South African traders and investors prefer Tickmill.com for the following reasons:

- Licensed and regulated

- Dedicated client support

- Spreads that start from 0 pips

- 84 trading instruments

- Negative balance protection

- Industry awards

- Segregated accounts

- Allows Expert Advisors (EAs) and algorithmic trading

Is Tickmill Reliable Forex Broker?

Although the Forex broker is not licensed in SA, South African traders can definitely trust it because it has received licenses from the following financial regulatory bodies:

- Tickmill Ltd is licensed by Seychelles Financial Services Authority (FSA)

- Tickmill UK Ltd is licensed by the Financial Conduct Authority (FCA)

- Tickmill Europe Ltd is licensed by the Cyprus Securities and Exchange Commission (CySEC)

Moreover, Tickmill UK Limited is part of the Financial Services Compensation Scheme (FSCA), an independent fund for clients. Its objective is to compensate clients if the firm shuts down or stops offering trading services.

Tickmill Europe Ltd is part of the Investor Compensation Fund, which protect clients and compensates them in case the Forex broker has to close down.

Moreover, the broker clearly mentions its contact details. The telephone numbers are +852 5808 7849 (sales), +852 5808 2921 and +65 3163 0958 (client support), and +248 434 7072 (office). The email address is [email protected]. The registered address is 3, F28-F20 Eden Plaza, Eden Island, Mahe, Seychelles.

Get Started with a Demo Account

If you feel that you lack the skills required for trading, you can get started at Tickmill.com with a demo account. The demo accounts at Tickmill.com work like a live account. The only difference is that clients use virtual funds for trading. If you open a demo account, you must log in regularly as demo accounts left inactive for seven days will expire.

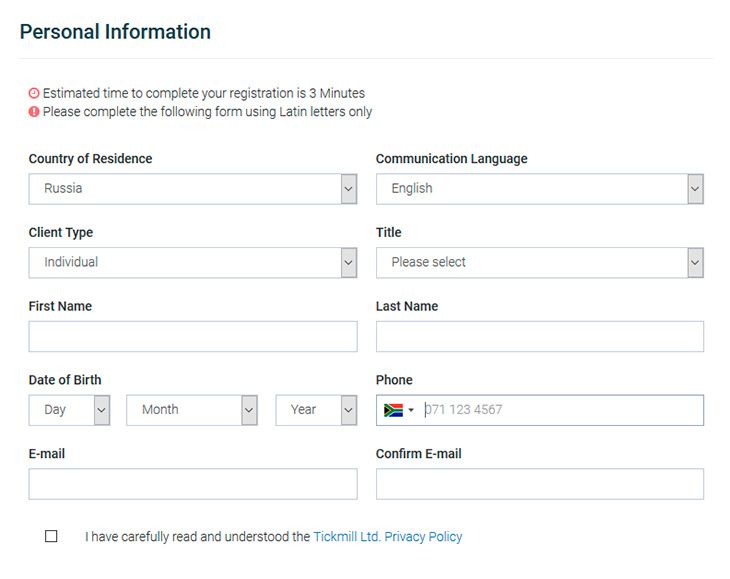

To open a demo account, traders have to fill in their names, phone numbers, and email address. They have to select their country from the drop-down box. They also have read, understand, and agree to the privacy policy. They have to agree to receive communication through email from the Forex broker. Finally, they have to click on the blue Proceed link.

Your demo account comes with a full-fledged MT4 trading platform, trading instruments such as gold and silver, bonds, 15 stock indices, and 62 pairs of currencies.

Account Types

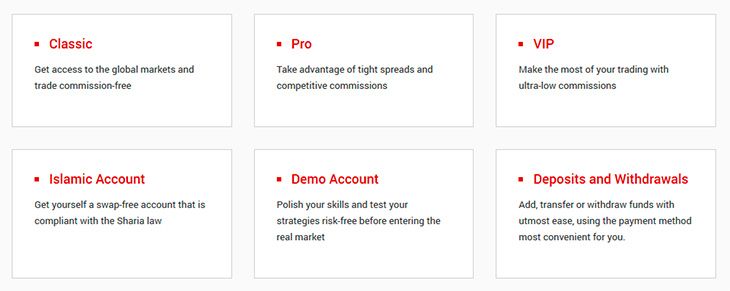

Tickmill.com offer several types of accounts to suit the trading requirements, goals, skills, and strategies of different types of clients. The following is a brief introduction to each type of account:

- Classic Account – You can open a classic account in USD, PLN, GBP, and EUR and deposit a minimum of 100. The spreads start from 1.6 pips and the maximum leverage is 1:500. Classic accounts come with zero commissions and options for swap-free Islamic accounts.

- Pro Account – Traders can open a pro account in USD, EUR, PLN, and GBP. The minimum deposit is 100, the maximum leverage is 1:500, and the spreads start from 0.0 pips. The commission is 2 per side per 100,000 traded. You also have the option of opening an Islamic pro account.

- VIP Account – VIP accounts support currencies such as GBP, PLN, EUR, and USD. The minimum deposit is 50,000. The spreads start from 0 pips, the max leverage is 1:500, and the commission is 1 per side per 100,000 traded. The option of swap-free Islamic account is also available.

- Islamic (Swap Free) Account – An Islamic account is a swap free account designed especially for those who obey Sharia laws. This type of account is absolutely free from rollover interest or swap from overnight positions.

Trading Instruments

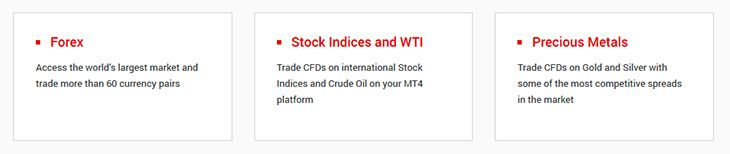

Tickmill.com offers a variety of trading instruments including CFDs on stock indices, currency pairs, precious metals, bonds, and crude oil.

- Forex Trading – Tickmill offers its clients the opportunity to trade 62 currency pairs, including minor, major, and exotic with fast execution and low spreads.

- Bonds – Trade German government bonds with no commissions and competitive spreads.

- Stock Indices and WT1 – Tickmill offers CFDs on crude oil and stock indices. Clients can access 15 global stock indices and WT1 with no requotes, no commissions, and no hidden mark ups.

- Precious Metals – Trade gold and silver at Tickmill.com. The margins vary according to your account leverage.

Trading Platforms

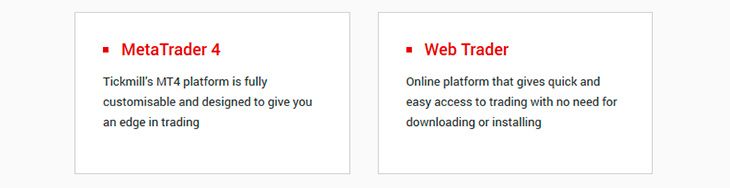

You can trade with Tickmill on any device of your choice. You can either download the MT4 software for your desktop or Mac computer or use the WebTrader to trade right in your browser.

MetaTrader 4

Tickmill’s MT4 platform is designed in such a way that clients can easily customize it according to their requirements. Here are the key features of this popular trading platform:

- No partial fills

- Micro lots are available

- EA trading facilities

- CFDs on stock indices, forex, bonds, commodities, WT1

WebTrader

The WebTrader platform is for traders who prefer to trade without downloading and installing any software. Here are the key features of this platform:

- Real-time quotes in Market Watch

- 9 chart timeframes

- Basic analytical objects: vertical, horizontal, and trend line, Fibonacci lines, and equidistant channel

- Customizable price charts

The WebTrader platform gives you easy and quick access to all financial markets. It is secure and enables one-click trading.

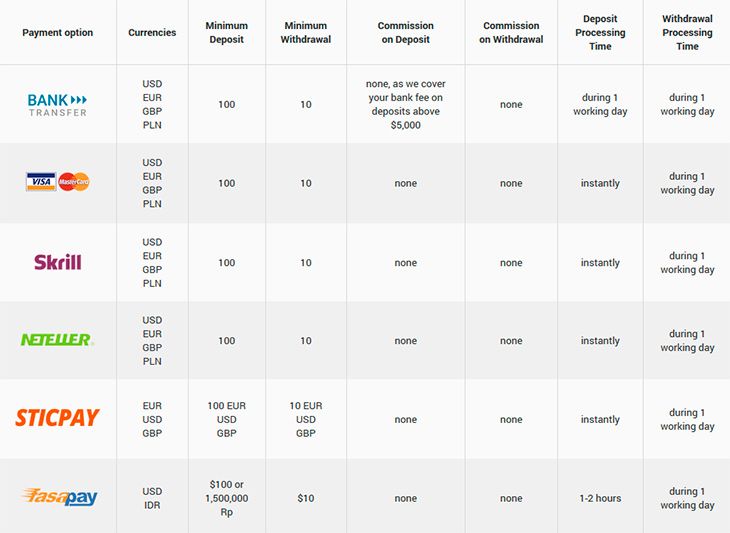

Tickmill Banking Information

All deposits that start from US$500 or its currency equivalent, made in a single transaction, are eligible for zero fees. Tickmill refunds transaction fees up to US$100 or its currency equivalent. To get a refund, customers have to send the FX broker a copy of the confirmation document, including bank statement.

Tickmill is popular for offer safe, easy, and instant payment methods.

- Bank Transfer

- Skrill

- Visa & MasterCard

- SticPay

- Neteller

- Fasapay

- Union Pay

- Qiwi Wallet

- GlobePay

Internal transfers between trading accounts are instant provided both accounts are in the same currency. If the currency is different, Tickmill requires one banking day to process the transaction.

Here are a few rules regarding deposits and withdrawals:

- Traders have to use a payment method that is in their own name.

- The broker does not charge clients for making deposits and withdrawals. It has nothing to do with the fees charged by banks, credit card companies, electronic wallets, and financial companies.

- Tickmill processes withdrawals through the same method used to make deposits.

- The company processes payments only in GBP, EUR, PLN, and USD. If you deposit in ZAR, it will be converted to one of the above-mentioned currencies.

Trading Tools

Tickmill offers a set of useful tools to help traders develop their trading strategies:

- Autochartist – The autochartist is a powerful technical analysis tool that can make it easier for you to trade faster. This tool has an advanced recognition engine that enables it to process huge quantities of data to identify key price levels and chart patterns across a variety of CFD and forex instruments.

- Forex Calculators – The Tickmill toolset includes a currency converter, margin calculator, and pip calculator.

- Myfxbook AutoTrade – Traders can alter their settings so that they can automatically follow successful traders and copy their trades.

- Tickmill VPS – The Tickmill VPS comes for BeeksFX and clients who opt for its services get 20% discount, 24/7 support through email and live chat, and 100% uptime guarantee.

- Forex Calendar – Use the Forex Calendar to check important economic indicators and events.

- One-click Trading – Traders have the option of expanding the functionality of their MT4 platform by using Tickmill’s one-click trading EA.

Promotions

Clients can use the special offers at Tickmill.com to boost their trading and grab rewards for their achievements.

The ECO IB Contest

The IB Contest is Tickmill.com’s IB community’s opportunity to expand their network of referrals and win their share of a $10k prize pool or a Hyundai IONIQ Electric.

Trader of the Month

The trader who is declared to be the Trader of the Month will receive a prize of $1000 and his/her name will be entered into the Wall of Fame.

Tickmill’s NFP Machine

The Forex broker will select a financial instrument during the NFP week and challenge its clients to guess its price on the MT4 platform at 16:00, half an hour after the NFP is released. If traders predict accurately, they will receive a prize of $500. If their prediction is close to the actual figure, they will receive a prize of $200.

$30 Welcome Account

Tickmill welcomes new clients with a welcome bonus of $30.

Tickmill Partnerships

Tickmill presents a number of opportunities for its clients to become its partners and run their business under its secure umbrella.

The following are three major ways to earn some extra cash at Tickmill:

- Introducing Broker (IB) – You can refer traders to Tickmill.com and earn commission whenever they make trades.

- Multi Account Manager (MAM) – This platform enables professional money managers to trade for their clients. MAMs can use this platform to manage multiple accounts from one place.

- Tickmill Prime functions on the mission of providing continuous liquidity and helping market participants worldwide to get the best prices in the asset classes it covers, irrespective of changing market conditions.

Tickmill.com FAQs

Q1: What happens to inactive trading accounts at Tickmill.com?

A: If you fail to log in to your Tickmill.com account for 90 days, the system will automatically archive the account.

Q2: Can I close my Tickmill.com account?

A: You can close your account, but Tickmill reserves the right to keep your information for a period of seven years.

Q3: Can I open a live account and a demo account at the same time?

A: Yes, it is possible. You have to install the MT4 trading platform in different folders on your desktop for your live and demo accounts.

Q4: What is the minimum amount I can deposit to my account?

A: You can deposit a minimum of $100 for all accounts. However, the minimum deposit amount for VIP accounts is $50,000.

Q5: Does Tickmill.com offer protection from negative balance?

A: You can get a negative balance only if you trade irresponsibly, miscalculate your risks, and use maximum leverage. Tickmill covers negative balance and makes sure that its clients cannot lose more money than they deposited. Moreover, its risk department continuously monitors trading activities and warns trades through email whenever necessary.

Our Take on Tickmill.com

Tickmill doesn’t have a South Africa license, but is still the number one choice for South African traders and customers because it has obtained licenses from three reputed jurisdictions. Moreover, Tickmill has great client support, a wide range of trading instruments and trading tools, and excellent trading conditions.

You can become a trader on Tickmill or earn extra cash by becoming a partner. If you are a new trader, we suggest getting started with a demo account as it is the best way to learn trading strategies.

Tickmill Review

South African traders and investors prefer Tickmill.com for the following reasons:

5